The Differences Between A Public Versus Private EquityThe Differences Between A Public Versus Private Equity

I’ve gathered some data here: 1. PE FIRM, (% MBAs) 2. Apax (77%) 3. Blackstone (63%) 4. KKR (61%) 5. Candover (59%) 6. Permira (58%) 7. 3i (48%) 8 (manager partner indicted). CVC (46%) 9. Bridgepoint (38%) 10. EQT (22%) 11. PAI (21%) By looking at the younger executives in the firm, there is also clear evidence that the MBA is becoming significantly popular amongst the new generation of buyout executives.

PE companies tend to hire their own kind, so the PE MBA community is a very closed circle. If you are interested in our MBA essay evaluation service by alumni from leading organisation schools, please get in touch at thomas@askivy.net. While PE companies tend to recruit individuals through their network first (e.g.

Clients vary from leading tier Financial investment Banks and Boutiques to Private equity homes in London. Contact Name: Jade Sweeney e-mail: jsweeney@argyllscott.com contact phone: +44 (0) 207 936 1125 (www.arkesden.com) Devoted stand alone Private Equity group with a track record and experience of the sector for over a years. Principal, Senior Associate, Associate and Executive level requires taking a pure search method for each required.

Almost half of placements in 2012 were beyond the UK. Source prospects from Financial investment Banking (M&A, Leveraged Financing and Financial Sponsors), lateral Private Equity professionals and Management Consultants. Contact name: Adam Cairns e-mail: awc@arkesden.com contact phone: +44 (0) 203 762 2023 (www.blackwoodgroup (local investment fund).com) Blackwoods is a London-based search firm that hires for a big range of finance and non-finance functions, however they likewise have a good recognition in the London private equity recruiting area.

Contact Name: Simon Hegarty email: simon.hegarty@ehpartners.co.uk contact phone: +44 (0) 203 432 2552 (www.keaconsultants.com) Kea Consultants is an executive search firm that specialises in moving young professionals from leading tier investment banks and consultancies into the buy-side. They deal with a special basis with companies such as Blackstone, TPG, Development & Och Ziff and have strong relationships with a variety of other funds varying in size e-mail: info@keaconsultants.com contact phone: +44 (0) 203 397 0840 (www.one-search.co.uk) Pure finance-focused firm with a good existence in private equity and hedge funds.

Private-equity Firm Sees A ‘Phenomenal Time’ To Do Deals

They primarily cover Europe and Middle East. (www.principalsearch.com) Professional financial services search firm providing worldwide hiring options to customers throughout a vast array of item locations within the financial investment banking and financial services sectors. Contact Name: William McCaw email: william.mccaw@principalsearch.com contact phone: +44 (0) 207 090 7575 (www.rosepartnership.com) Big recruitment firm based in UK.

They hire for Banking and Private Equity. (www.walkerhamill – titlecard capital fund.com) Walker Hamill is widely acknowledged as one of Europe’s leading recruiters in private equity, endeavor capital, property, secondaries, fund of funds, mezzanine and hedge funds. It recruits for financial investment positions from Associate to Partner level and infrastructure functions including finance & accounting, fund raising, financier relations, compliance and portfolio management.

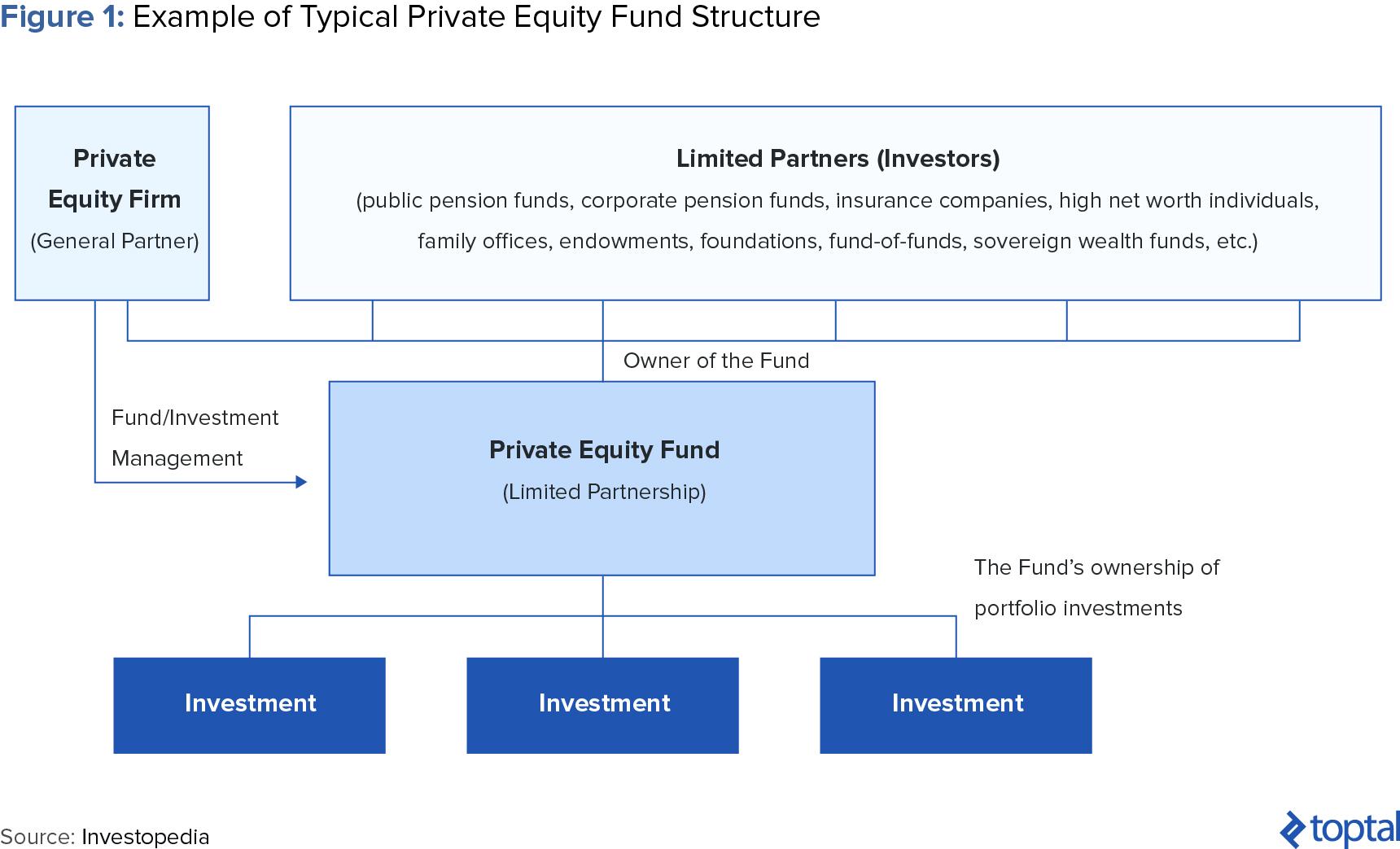

Particular funds can have their own timelines, investment goals, and management viewpoints that separate them from other funds held within the same, overarching management firm. Successful private equity companies will raise numerous funds over their life time, and as firms grow in size and complexity, their funds can grow in frequency, scale and even specificity. To get more info regarding business partner and also - visit his podcasts and -.

Prior to founding Freedom Factory, Tyler Tysdal handled a development equity fund in association with several celebrities in sports and entertainment. Portfolio company Leesa.com grew quickly to over $100 million in profits and has a visionary social mission to “end bedlessness” by donating one mattress for every ten offered, with over 35,000 donations now made. Some other portfolio business were in the industries of wine importing, specialty financing and software-as-services digital signs. In parallel to managing properties for services, Tysdal was managing private equity in real estate. He has had a number of effective private equity investments and a number of exits in student housing, multi-unit real estate, and hotels in Manhattan and Seattle.

It is not unusual for Private Equity firms to get thousands of CVs per year, and much more for the significant funds. Similarly, investment experts tend to get bombarded by e-mails and calls inquiring and aid to secure an interview. So, how can you differentiate yourself amongst all those CVs? In Europe, Private Equity firms might only work with 100 approximately new partners every year in total.

To illustrate what you are up against, the Private Equity clubs from Harvard and Wharton have more than 800 members each. If you contribute to that number the expert and junior associates classes of Goldman Sachs, Morgan Stanley, McKinsey, Bain & Co, and so on, you will be really quickly in the several thousands of well-educated, well-trained candidates who will complete versus you for a handful of jobs.

However only speak about the languages you speak with complete confidence or the areas you actually worked/lived in. Then connect to people from those regions when sending your CV, and mention this plainly to the headhunters. Note that if you speak a language however never worked in the nation, that might be a handicap, so you need to mention that you spent a variety of years in said country.

What Is Private Equity – Pomona Investment Fund

– Specific deal exposure: Pointing out deals where you either worked with the private equity fund or where it was an under-bidder is a good angle to start a discussion with a PE fund, as they will be able to check your understanding and capabilities really quickly. This may backfire though – make certain you understand the offer inside and out.

– Educational background: Utilize your alumni base as much as you can, however don’t restrict yourself to your own school. For instance, a top MBA is likely to be well gotten by somebody from another top school. – Business alumni: Likewise, reach out to people who worked at the very same firm than you (fund manager partner).

For circumstances if you operated at McKinsey and you are connecting to somebody who worked at a rival firm, it is still more likely to work than reaching out to an ex-banker. – Other connections: Ex-military, particular background (i.e. if you studied medecine, law, and so on), same associations, etc. If you build your profile along those verticals, you will now see that you can distinguish yourself effectively and make yourself a lot more memorable to the companies.

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

You require to target funds, and then tailor your message appropriately. For example, if you are in a specific sector team, try to diversify your CV if you use to a generalist fund (i.e. less detail about the sector/deals, highlight some other experiences, etc). If you use to an all-British fund, there is no need to discuss your global experience or language abilities at length, and so on – prosecutors mislead money.

However, in the end, the “fit “is what truly distinguishes one prospect from another, all else being equivalent (i.e. same efficiency in the technical tests, modelling tests, etc, which is under your control if you practise). At all times throughout the process, do not forget to preserve a well-mannered and simple attitude, which, surprisingly, is a location where numerous candidates fail.

Private Equity Faqs – American Investment Council

In addition, headhunters are extremely selective when sharing job opportunities in PE so you might miss out on a prospective interview. Sending “cold emails” is commonly accepted in the PE market, and if the e-mail is appropriately crafted, you need to be getting a response in many cases. So find below a few strategy ideas for cold e-mails to Private Equity specialists – pay civil penalty.

> Limit to a set of top priority companies (7 to 10 firms maximum) that you believe would be the best fit and most appropriate to your background. Sending out appropriate cold e-mails is in fact quite lengthy, which is why we recommend to focus as much as possible at first. > Seniority: We would advise that you prevent reaching out to an extremely junior person, or one at your exact same level, for a number of factors (they are the busiest, there may be a worry of competitors, a lack of incentive to help), or to those too senior (most will not care or have time) (indictment obtained foxchannel).